Introduction

The world of finance is being rapidly changed and improved by decentralized finance, commonly known as DeFi. Unleashed and empowered by blockchain technology, this exciting new ecosystem is jolting the traditional finance sector with a plethora of innovative services that eliminate the middlemen. An investor with huge interest in DeFi should comprehend the technical components and the huge opportunities it comes with.

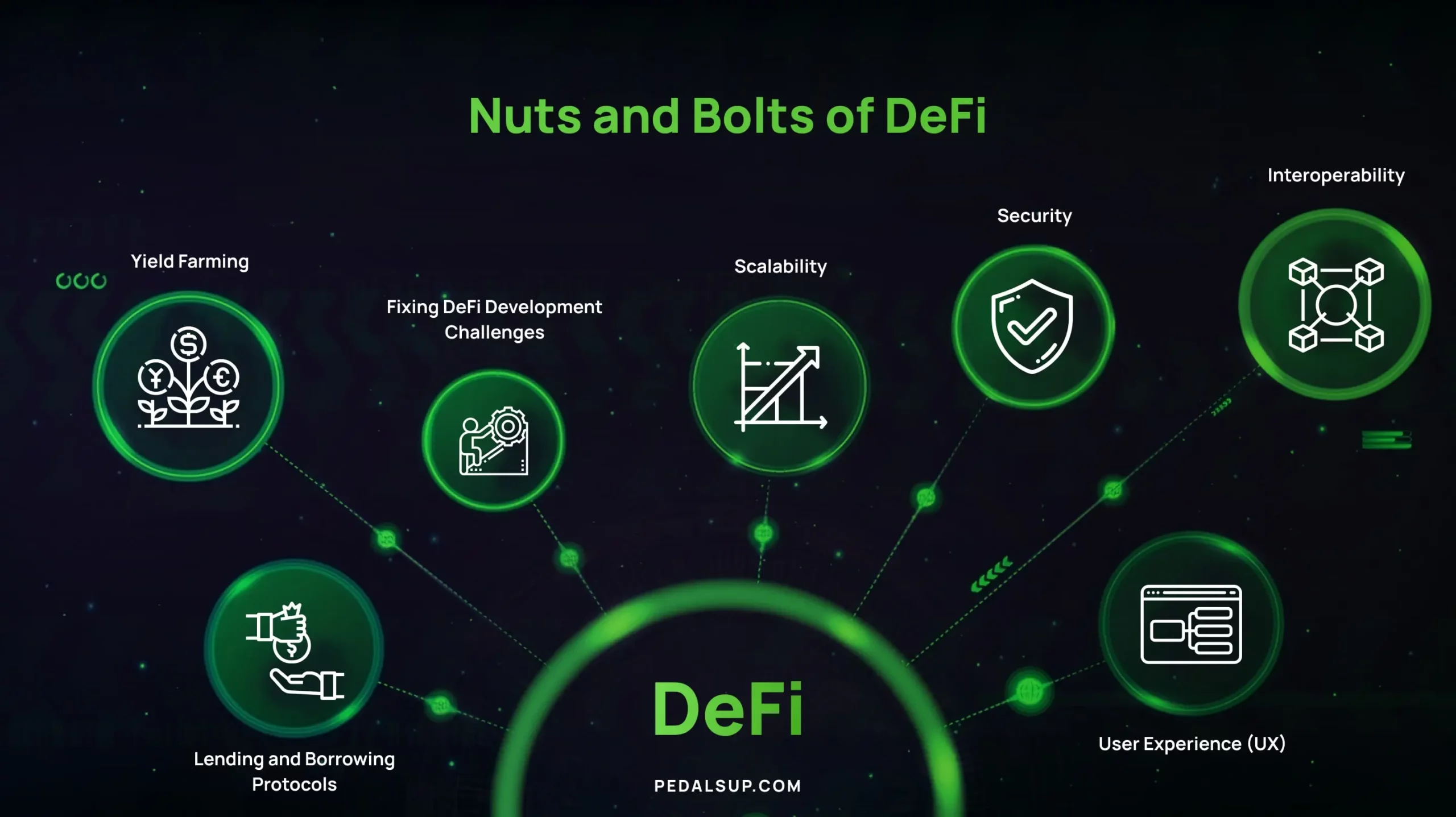

Nuts and Bolts of DeFi

The reality is that smart contracts are self-executing agreements residing on platforms with complete transparency and reliability, which thereby give rise to trust in a decentralized world. But if there’s a bug in the code, that could be really bad, as we’ve seen in the past. Some other key components of DeFi are oracles, which act as bridges between applications and DeFi, connecting them to the real world via providing important off-chain data to smart contracts. For instance, Chainlink is one of the known projects for the provision of reliable data feeds to many different DeFi platforms. DEXs permit peer-to-peer trading through a decentralized order book and go by names such as Uniswap. They use automated market makers who ensure that there always is liquidity in these pools.

- Lending and Borrowing Protocols– Many platforms, such as Aave, allow people to lend or borrow crypto assets often under overcollateralized models for risk management.

- Yield Farming– This rewards users who can provide liquidity, allowing them to deposit crypto assets in liquidity pools, typically seen on platforms like SushiSwap.

- Fixing DeFi Development Challenges– DeFi application development is indeed very challenging. Below are some of the main challenges:

- Scalability– In parallel to the growth of DeFi, blockchain platforms should address more transactions and higher complexity. Solutions like layer-2 scaling and sharding can help manage this.

- Security– Comprehensive security audits and top-notch safety measures are required to protect user funds from hacks. Services like CertiK can help identify and fix vulnerabilities.

- Interoperability- It will indeed be very crucial that the various DeFi protocols and blockchain networks can interoperate with one another. Such a situation can happen only with proper planning. This is where a tool like Polkadot comes in.

- User Experience (UX)- Making complex financial products easy to adopt by most people should involve good design. Designing with the user at the center reconciles cutting-edge technology with user-friendly interfaces.

What to Look for in a DeFi Project

If you’re going to invest in a DeFi project, you need to do some homework. Here are some of the things that should be considered:

- Security Audits on Smart Contracts- A security audit on this project must be undertaken to leave behind all the bugs and discrepancies.

- Selection of the Blockchain Platform- Look for relative strengths and weaknesses of the blockchain platform selected, particularly scalability, security, and developer support.

- Economic Model- Understand the project’s tokenomics: how tokens are used, distributed, and incentivized.

- Team’s Expertise- Evaluate the experience of the team and the technical skills in the development of DeFi applications and smart contracts.

Real-World DeFi Examples

Let’s now consider some real-world applications of DeFi:

- Decentralized Lending- This is where projects like Aave and Compound operate, providing the ability to borrow and lend with cryptocurrencies. This, in essence, allows liquidity providers to directly lend or borrow funds using the protocol. They do have higher interest rates compared to traditional banks.

- Decentralized Exchanges (DEXs)- Trading users can be endowed with significantly more transparency and security through trading applications, including Uniswap and SushiSwap.

- Yield Farming– The practice will enable users to get returns on the DeFi ecosystem and earn passive income through yield farming.

- Stablecoins– Cryptocurrencies pegged to the price of fiat currencies, such as USDT and USDC, that are used for everyday transactions because of their stable value and price.

- Insurance- DeFi protocols can offer coverage against a number of risks, such as smart contract failures or price volatility, providing another layer of security for users.

The Future of DeFi: Trends and Predictions

The DeFi landscape is ever-changing. These are the key trends and predictions for the future:

- Integration with Traditional Finance- DeFi, when it grows mature, will lead to further integration with traditional financial institutions. DeFi may result in hybrid models taking the best from each of the two worlds.

Regulatory - Developments– As DeFi grows, regulatory scrutiny will increase. Although this may pose some challenge, it also provides legitimacy and attracts other mainstream users.

- Layer-2 Solutions and Scalability– The adoption of layer-2 solutions and other scalability technologies will go mainstream to service more considerable demand, hence decongesting the network and bringing down the cost of transactions.

- Interoperability- Enhanced interoperability between different blockchain networks will result in a better-connected and efficient DeFi ecosystem.

- Decentralized Identity- Onboarding of the DID systems will ensure added safety and privacy for the users while working with their identity on these platforms.

- Automated Compliance– Smart contracts will integrate automated compliance features to ensure its decentralized nature, now more than ever before.

- NFTs and DeFi- The intersection of nonfungible tokens and DeFi is set to grow into new forms of finance products and services around digital assets.

Benefits of Investing in DeFi Development

DeFi development can potentially lead to several benefits, as described below:

- Innovation and Disruption– Be a leader in a dynamically changing financial landscape. The use of the AMM model at Uniswap has rocked the trading space.

- Better User Experience– Offer your users more visibility, access, and autonomy over financial services with something like MetaMask.

- Efficiency– Minimize all intermediaries in the run and quicken the entire process right from when it starts to the end. Just what DEXs bring to the market.

- High Returns– DeFi offers novel methods of obtaining returns on investment, a fact being avidly researched by yield farmers themselves.

Conclusion

The DeFi space is full of promise, but it’s important to approach it with your eyes wide open. By understanding the technical details, doing thorough due diligence, and partnering with a reliable team like Pedals Up, you can increase your chances of success in this dynamic and transformative industry.

Here at Pedals Up, we offer a full stack of services across the spectrum of blockchain development including DeFi development. Our expert team is obsessed with secure, scalable, and inventive solutions. We work closely with our clients, whether in smart contract development, security audit, or user-friendly design, to turn their vision into reality. That end-to-end support will start from a concept to launch.

Ready to learn more? Contact us today to dive deeper into specific technical aspects of DeFi development, such as smart contract security, DEX algorithms, or oracle integration. Let us know what interests you, and let’s build the future of finance together.